Table of contents

Reading time: 8 minutes

In the 21st century, the video game industry is evolving in many directions. New games become more colorful, the sound range improves. The total annual income of companies producing computer and mobile applications in 2019 exceeded $120 billion. Many of these companies have issued shares that are traded on stock exchanges and are available for purchase by an ordinary man in the street. Today we are talking about our colleagues - major global game publishers who have placed their securities on the stock exchange and how they are traded and what affects their profitability.

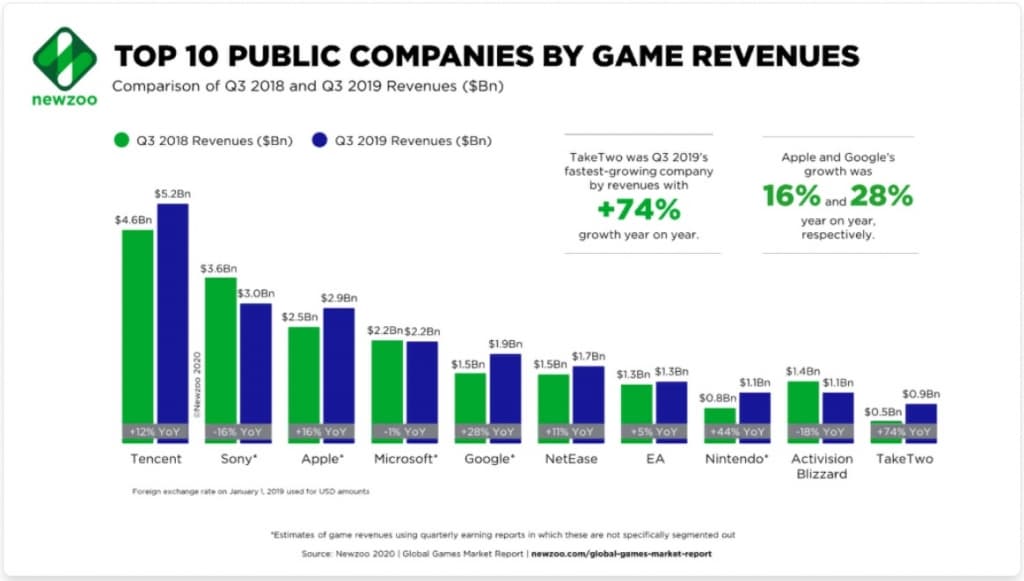

Most of the major players in the computer, console and mobile game development market showed an increase in profits in 2019 compared to 2018. The exception was Activision Blizzard due to the lack of successful releases. The list of the most successful game development corporations published by Newzoo at the end of 2019 included such giants as Sony, Apple, Microsoft, Google. Microsoft has 23 studios that make games for the Microsoft Xbox. But the shares of these studios are not traded on the stock exchange. You can become their shareholder only by purchasing shares of the parent company - Microsoft. A similar situation is observed with Sony. Sony Interactive Entertainment was spun off from Sony as a separate company in 2016 but did not go public. She makes games for the Playstation.

https://newzoo.com/insights/articles/top-10-public-game-companies-earned-21-5-billion-in-q3-2019-alone/ - Statistics from Newzoo on the most profitable companies operating in the computer and mobile games industry in 2018 and 2019. The results of the current - 2020 year have not yet been summed up.

Shares of Apple, Microsoft, Google are freely traded on the St. Petersburg Stock Exchange. To purchase them, you must conclude an agreement with a broker that provides access to this exchange. Shares of American companies are not listed on the Moscow Exchange yet.

Sony shares are OTC securities and require Qualified Investor status to purchase. The status can be obtained if you have a specialized education or 6 million rubles in your account, or the same turnover per year.

Tencent

Tencent is a giant Chinese holding company specializing in high-tech processes. In 2017, its capitalization exceeded $500 million. The company became the 5th in the world in terms of capitalization. Tencent went public in 2004 and listed its shares on the Hong Kong Stock Exchange. Currently, its shares are included in the main index of the Hong Kong Stock Exchange.

In 2019, about a third of the company's revenue came from computer games. The company owns the following games:

- PUBG Mobile;

- League of Legends;

- Crossfire;

- Clash of Clans;

- Path of Exile.

At the time of the placement of shares on the stock exchange, their cost was $0.1 per share, now it has increased to $78. Since 2004, the securities issued by the company have been constantly increasing in price, with the exception of 2018, when there was a strong decline. The main reason for the decline is the beginning of the trade war between the United States and China; in 2018, the fall of some Chinese indices reached 38%.

In order to purchase Tencent shares, you must be a Qualified Investor. For this reason, it is better for a novice investor to pay attention to other stocks, for example, American game development corporations.

Electronic Arts (EA)

EA is one of the first American companies in the gaming segment. The company develops games for computers and mobile devices, as well as for popular game consoles. Capitalization of EA - 40.7 billion dollars. Electronic Arts is the developer of such popular game series as:

- Fifa;

- The Sims;

- Medal of Honor;

- Need for Speed.

The main profit of the company comes from content purchased by users in games. Mobile applications bring the least.

The price of one share of Electronic Arts is approximately $122. The company does not pay dividends. EA has good multiplier performance:

- P/E = 17.77, lower than the industry, so we can say that the company is clearly undervalued;

- ROE = 27.8% - EA capital is used quite efficiently, at the beginning of the year the figure reached 40%.

Since December 2018, there has been a constant increase in the share price, in August 2020 a collapse began, which reached 15% by November 2020. The reason for the fall is the delay in the release of Battlefield V and the claims of the Dutch authorities to Fifa. Nevertheless, such experts as Stiffel Nicolaus, UBS, Needham forecast price increase to $163-170 per share. The company plans to release 4 major games in the near future, which should have a good effect on the value of EA shares.

Activision Blizzard (AB)

AB is an American company whose main activity is the development of video games. The corporation was established in 2008 in the USA from two companies: Activision and Vivendi SA. Both of these companies before the merger were engaged in the creation of games, video hosting, telecommunications, video and music creation. AB is the publisher of the following applications released in 2019-2020:

- World of Warcraft: Shadowlands;

- Warcraft III: Reforged;

- Call of Duty: Modern Warfare;

- Call of Duty Mobile;

- Crash Team Racing Nitro-Fueled;

- Diablo Immortal;

- Masters of Bullets - Collection Soldier of Fortune.

The current price of one share is $75. Activision Blizzard raised $400 million in the UK and US in one day in 2011. The company pays dividends at an average rate of 0.54% of the value of the security. This is a fairly high figure for an American company. The company has had its ups and downs over the last 3 years. At present, such world experts as UBS, Stifel Nicolaus, Wells Fargo, Morgan Stanley, Needham, Robert W. Baird, predict the growth of the share price up to $100-100 per share. Experts note that the company is switching to the creation of games that bring greater profitability. In the long term, this should have a positive impact on the share price. Now AB receives 30% of its profits from the sale of new copies of games. This is one of the highest rates among game publishing corporations.

Most experts around the world believe that during the financial crisis caused by a new coronavirus infection, buying securities in gaming companies is a good investment. When restaurants, bars and other places of entertainment close, people start playing more on computers, consoles, tablets and phones. Partly for this reason, at the very beginning of the crisis, gaming companies fell less than other market participants. The fourth quarter is usually the most profitable for developers, the same dynamics is expected in 2020.